4 Reasons To Sell Your Stocks Today

Stocks have plummeted since the beginning of October. And that decline is a predictor of economic troubles ahead for the U.S. economy.

If you need the money from your stocks in the next five years, you should sell them before they lose even more value. If you have a longer time horizon, grit your teeth and suffer patiently.

Some day stocks will bottom out and keep rising -- if you have the stomach for it, their decline will create a great buying opportunity -- until the next market collapse.

When you see Warren Buffett offering to finance GE's debt, you'll know the bottom is in sight.

Just how bad is the market carnage? The S&P 500 has lost 8.2% since its late September high of 2,930 and the NASDAQ has fallen 13.3% from its August high of 8,110.

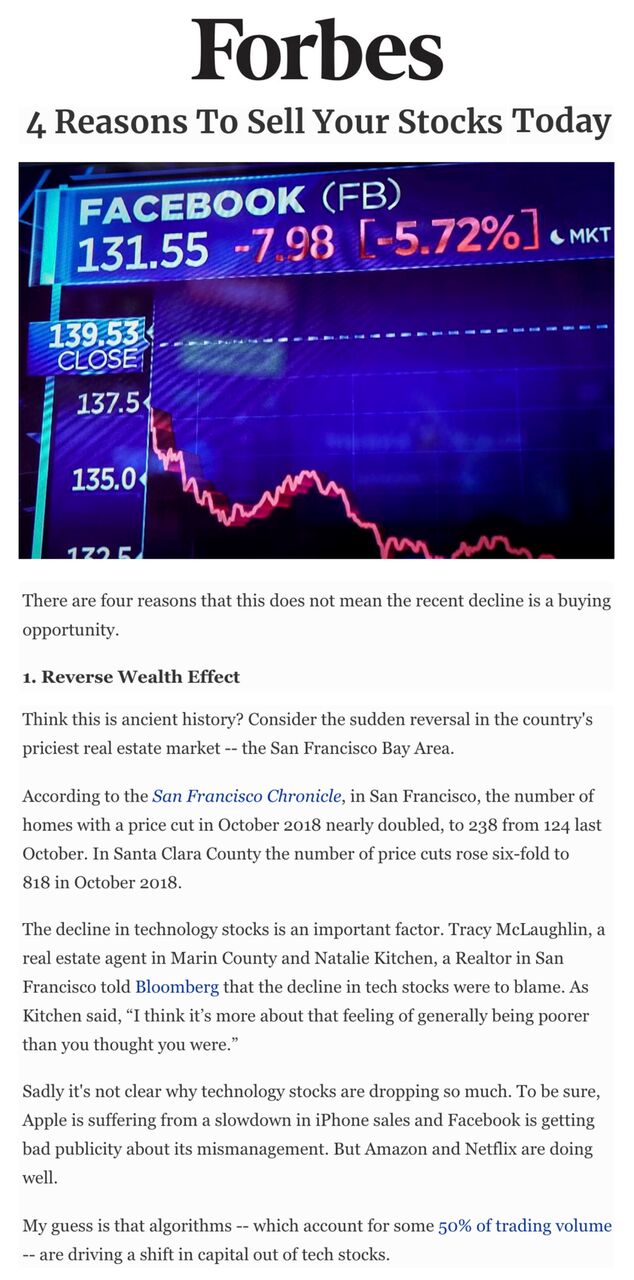

Meanwhile, tech bellwethers have plunged: Facebook trades down 40% from its July 2018 high of $217.50 and Amazon has fallen 26% from its September high of about $2,040.

Does this have any effect on the U.S. economy? After all, the U.S. GDP grew 3.5% in the third quarter and household wealth increased to a record $106.9 trillion in the second quarter of 2018, according to the Federal Reserve -- driven by a $1.7 trillion increase in the value of financial assets and a $496.1 billion increase in household real estate.

There are four reasons that this does not mean the recent decline is a buying opportunity.

1. Reverse Wealth Effect

These economic statistics reveal a critical connection between stocks, real estate and human psychology.

When stock prices rise, those who own them feel confident in bidding up the price of real estate. What's more, when interest rates are low, they don't mind borrowing lots of money to buy the houses.

Conversely, when stocks fall, it does not take long for people to suffer from a reverse wealth effect. As Robert Samuelson wrote about a decade ago

The "wealth effect" refers to the tendency of people to adjust their spending as their wealth -- concentrated heavily in housing and stocks -- changes. When wealth rises, spending strengthens; when wealth falls, spending weakens. Now the wealth effect is reversing. As stock and home values drop, Americans are scrambling to increase savings and curb spending. The economist Nigel Gault of IHS Global Insight estimates that every dollar's change in wealth causes people to change their spending by 5 cents. If so, the hit to consumer spending would be $450 billion ($9 trillion times .05).

Think this is ancient history? Consider the sudden reversal in the country's priciest real estate market -- the San Francisco Bay Area.

According to the San Francisco Chronicle, in San Francisco, the number of homes with a price cut in October 2018 nearly doubled, to 238 from 124 last October. In Santa Clara County the number of price cuts rose six-fold to 818 in October 2018.

The decline in technology stocks is an important factor. Tracy McLaughlin, a real estate agent in Marin County and Natalie Kitchen, a Realtor in San Francisco told Bloomberg that the decline in tech stocks were to blame. As Kitchen said, “I think it’s more about that feeling of generally being poorer than you thought you were.”

Sadly it's not clear why technology stocks are dropping so much. To be sure, Apple is suffering from a slowdown in iPhone sales and Facebook is getting bad publicity about its mismanagement. But Amazon and Netflix are doing well.

My guess is that algorithms -- which account for some 50% of trading volume -- are driving a shift in capital out of tech stocks.

2. Trade War and Tariffs

Fund managers seem spooked by trade war and tariffs -- indeed Jared Woodard, global investment strategist at Bank of America Merrill Lynch told the Wall Street Journal that investors were surprised that the “The tech sector, especially in the U.S. is more exposed to political and regulatory risk than a lot of investors were prepared for."

The November BAML Fund Managers survey revealed the largest drop in allocation to tech in October since the financial crisis -- likely to cause more pain for investors. As Woodard told the Journal, “The trade conflict is a tech arms race and something not likely to be resolved in any major way in the near term. We suggest more pain for financial markets is likely."

3. Corporate debt

Compared to the Bush-era financial crisis, the locus of institutional debt has shifted. According to the Wall Street Journal, in 2005 nonfinancial corporate debt was relatively small -- at the lowest relative to GDP since 1993. Mainly banks and the financial sector were overleveraged.

Today, banks have solid liquidity buffers while "nonfinancial companies have been on a borrowing spree fueled by cheap money," according to the Journal. Indeed corporate debt stood at a record 45.5% of GDP, surpassing a level it last reached in 2008 as the economy was entering a recession, according to Moody’s Investors Service.

This brings us to GE -- which at $122 billion in debt is the biggest corporate borrower. If GE debt -- which remains three rating notches above junk -- gets downgraded, the effect on the overall financial markets could be particularly harsh, according to the Journal.

And GE's decision not to provide financial guidance earlier this month is doing nothing to alleviate fears of such a downgrade.

4. Lowered earnings growth

Rapid earnings growth makes stocks attractive. So when earnings are expected to grow more slowly, stocks ought to adjust downward.

Indeed earnings are expected to slow down. For all of 2018, analysts expect the S&P 500 to report 23.2% earnings growth according to Yardeni Research. Sadly, growth is expected to decelerate to 9% in 2019.

Given the reverse wealth effect, the uncertainty regarding the trade war, and the risk in the corporate debt market, that 2019 earnings growth rate sounds optimistic to me.

If GE debt gets downgraded, look out below. And should Warren Buffett strike a deal with GE, that could mark a buying opportunity.